7-Eleven – one of the most famous convenience store chains in the world is running out of steam after announcing the closure of 444 of its stores. Although the company gave the reasons as falling sales, falling customer numbers, inflationary pressures and especially a sharp decline in cigarette purchases. But the real reason behind 7-Eleven’s sluggish business situation is much more than that!

7-Eleven pioneered the concept of “convenience retail”

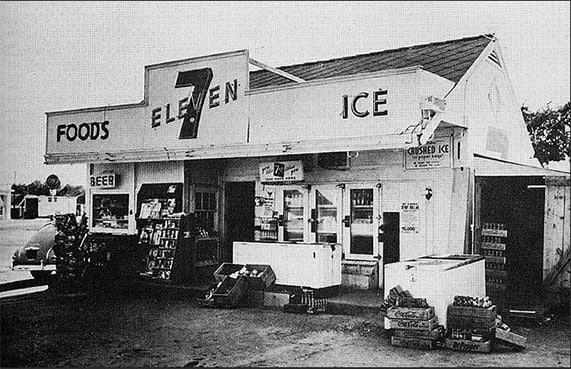

7-Eleven was founded by JC Thompson in 1927 under the name Southland Ice, headquartered in Dallas, Texas (USA). Starting out as an ice dealer, 7-Eleven later sold milk, bread, and eggs in the evenings and on Sundays when grocery stores were closed. This unique business idea was very new at the time and met the needs of customers.

By 1962, nightlife was becoming more popular in the United States. However, it was difficult for people, especially young people, to find any stores that were open all night.

Understanding customer psychology and capturing the trend of shopping at all times, 7-Eleven decided to switch the entire system to 24/7 service – a wise decision that made 7-Eleven the first convenience store chain in the world to have this service. It is not an exaggeration to say that 7-Eleven has laid the first bricks for a new type of convenience model in the world.

In its early years, 7-Eleven’s marketing strategy was to fill the niche between supermarkets and grocery stores. Therefore, their growth area was the suburbs in the United States. By choosing a smart niche and being open 24/7 – something that grocery stores and supermarkets could not do at that time, 7-Eleven quickly expanded across the United States. By 1963, the brand had 1,000 stores across the United States.

Then, 7-Eleven began to expand globally by applying the franchise model in Canada, Mexico and Asian markets. In particular, realizing the potential of the Asian market, 7-Eleven Corporation decided to move its headquarters to Japan in 2001. At its peak, 7-Eleven was also known as the “most terrifying” convenience store chain in the world when a new store appeared every two hours. From a small ice dealer, 7-Eleven has made a spectacular breakthrough to become a convenience store “empire”. The brand currently owns 83,000 stores worldwide, spread across 19 countries . Of which, Japan has the largest number of stores with more than 20,000 branches . The largest market after Japan is the United States – where 7-Eleven has been very successful with its coverage strategy at gas stations.

Signs of exhaustion as 7-Eleven is on the brink of having to transfer ownership to the parent company of rival Circle K

In recent years, 7-Eleven has shown signs of weakness and decline, with the number of customers coming to 7-Eleven falling 7.3% in August 2024, marking 6 consecutive months of declining traffic. Cigarette sales, which are the best-selling items in the convenience store segment, have also dropped 26% since 2019. Most recently, the parent company announced that it would close 444 underperforming branches in North America, which surprised the public. Although the number of stores closed only accounts for 3% of the 13,000 7-Eleven locations operating in the US and Canada, that is enough to show the struggles of this “giant” in a market with many formidable competitors.

In addition to the dismal sales and the closure of many branches, 7-Eleven has also raised concerns about being acquired by Circle K owner – Couche-Tard. In response to the difficulties of this convenience store chain, Couche-Tard has raised its acquisition bid to 47.2 billion USD, 20% higher than the previous bid and the current stock price of the Japanese company. This is the third time in the past 2 decades that Couche-Tard has tried to buy Seven & i Holdings – the parent company of 7-Eleven.

It is too early to say whether this merger will be successful or not, but the current situation of 7-Eleven makes experts and consumers worried.

Explaining the struggles of the world’s largest convenience store chain

Blurry brand positioning in a fiercely competitive market

Despite being in the market for hundreds of years, when mentioning 7-Eleven, users still do not remember a distinct feature. The items that the brand provides such as snacks, drinks, canned and processed foods are all on the shelves of most other convenience stores and large supermarkets. The absence of a unique “signature” product makes 7-Eleven become obscure in the retail market, where differentiation plays an important role in maintaining and attracting customers.

In the past, 7-Eleven had the upper hand thanks to the convenience of its 24/7 stores. However, 7-Eleven is no longer the only player in the market with this advantage. The rise of fast delivery and e-commerce has changed the game. Platforms like Amazon Fresh, Instacart, and large chains like Walmart have expanded their same-day and even hourly delivery services, providing customers with greater convenience without having to leave their homes. 7-Eleven was slow to catch up with these trends, resulting in its loss of convenience leadership.

The business model associated with gas stations (in the US) is becoming obsolete with the explosion of electric and hybrid vehicles.

7-Eleven’s strategy of covering gas stations in the city began to become popular in the 1960s in the United States. This was once considered a strategic “move”, but now it is probably no longer suitable and effective for the company’s business. Accordingly, 7-Eleven cooperates with gas stations to integrate its convenience stores into this area, where consumers can shop for products such as cigarettes, drinks, and convenient foods while they fill up their gas. This model helps take advantage of customer traffic to gas stations to increase revenue from consumer goods sales.

Selling cigarettes at gas station stores is a key part of 7-Eleven’s business strategy, and cigarettes have become its best-selling item. But as of 2023, cigarette sales have fallen by more than 50% compared to two decades ago. The main reasons include stricter smoking restrictions and higher taxes on the product, and a consumer trend toward alternatives like e-cigarettes instead of traditional cigarettes.

Not only has 7-Eleven plummeted with a serious decline in cigarette sales, but the sales model at gas stations itself has made it dependent on the gasoline market situation. The government and automakers’ push to switch to electric and hybrid vehicles has severely affected gasoline demand. These vehicles consume less fuel or do not use traditional gasoline, leading to a decline in gasoline sales. And as a result, cigarette sales in particular and 7-Eleven’s products in general at these branches have dropped dramatically. The company’s store model combined with gas stations is considered too outdated and needs to be reformed if this situation is not to continue and worsen.

Changing consumer habits: Preference for products at large supermarkets and trend of online shopping at home

The difficult and gloomy economy has directly affected consumer behavior. McKinsey’s 2022 report shows that consumers are shifting to buying more necessities with a 60% reduction in the need to buy luxury items. Or up to 50% of consumers have changed their shopping habits, by going to stores with lower prices, looking for promotions, or choosing to buy discounted goods (according to Nielsen IQ 2023 report).

In its 2022 financial report, Seven & I Holdings also had to admit that although the US economy is recovering strongly, consumers are still limiting spending due to persistent inflation, high interest rates and limited job opportunities. People tend to cut unnecessary expenses, and therefore visit convenience stores like 7-Eleven less.

When they do need to shop, they will also look for larger supermarkets like Walmart and Costco. Because essential products here are more diverse and sold at cheaper prices. Meanwhile, 7-Eleven is mainly positioned as a convenience store, not a place where consumers regularly go to buy food in bulk at competitive prices.

Along with that, the trend of online shopping is increasingly flourishing. A 2021 McKinsey study found that 75% of consumers tried online shopping during the pandemic, and the majority of them continued this habit. Thanks to the change in shopping habits, Amazon – the e-commerce giant – reported revenue of up to 469.8 billion USD in 2021, an increase of 22% compared to 2020. The convenience, speed and ease of online shopping make users just want to sit at home, choose products through the phone screen and wait for delivery to their home instead of having to go to convenience stores like before. Competition from these e-commerce platforms with promotions, discount codes, and free shipping makes online shopping even more attractive and completely overwhelms expensive convenience store chains like 7-Eleven.

Lost in an ineffective strategy to shift to fresh food

7-Eleven has been trying to shift its strategy, focusing on investing in fresh food sales, especially in the US, by working with suppliers to improve the food supply chain. The reason is that in 2023, 7-Eleven’s total sales in the US will be $17 billion, of which nearly a quarter will come from 315 million cups of coffee, 153 million cups of shaved ice syrup, 99 million pizzas, 100 million hot dogs. This business result makes the company expect to sell more food because the demand for them is not as easy to decrease as gasoline or cigarettes. “We believe that we need to change our business model from relying on gas stations and selling cigarettes to a supermarket model where customers choose us based on other products. The key to this change is fresh food,” said Ryuichi Isaka, CEO of Seven & I Holdings.

However, according to Inc., consumers’ perceptions of brand positioning are not easily changed. People will stop at 7-Eleven for coffee and snacks, but when it comes to fresh food, they think of other names like Walmart, Costco, or specialty stores like Whole Foods. These chains not only have advanced supply and storage systems, but also the ability to buy in bulk at low prices, allowing them to compete on price and quality. Consumers tend to trust and choose to buy fresh food from larger retailers over convenience stores.

Summarize:

The fact that 7-Eleven had to close 444 branches clearly shows the major challenges that this brand is facing in the context of the changing market. The blurred brand positioning, the decline in sales of staple products, fierce competition with large supermarket chains and changing consumer habits have seriously affected the business performance of this convenience store chain. To overcome this situation, 7-Eleven needs a comprehensive reform to adapt to the current situation, if it does not want to be acquired by other “big guys” in the market.

Comment Policy: We truly value your comments and appreciate the time you take to share your thoughts and feedback with us.

Note: Comments that are identified as spam or purely promotional will be removed.

To enhance your commenting experience, consider creating a Gravatar account. By adding an avatar and using the same e-mail here, your comments will feature a unique and recognizable avatar, making it easier for other members to identify you.

Please use a valid e-mail address so you can receive notifications when your comments receive replies.