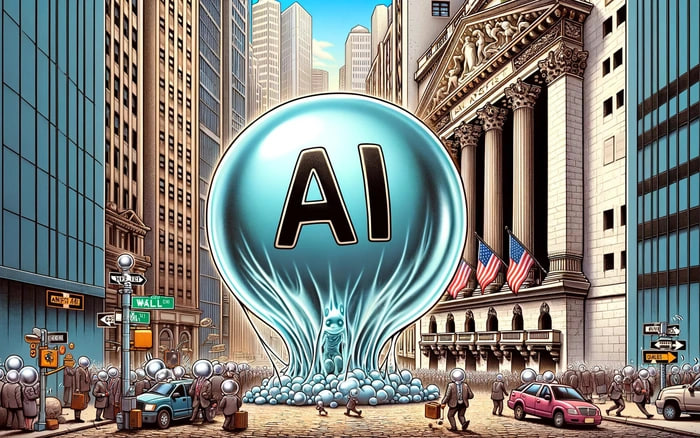

The hype surrounding AI has fueled investor and consumer expectations for the new technology. But in reality, AI is running counter to the billions of dollars invested in it, with the expectation of super-returns. It’s time for AI to be put back where it deserves to be.

The value of many tech companies is pushed up in the AI fever

The emergence of Artificial Intelligence (AI) technology has raised the value of many technology giants to unprecedented highs. In November 2022, Chat GPT was officially launched, from which the AI fever began to form globally. Just 6 months later, in April 2023, the company that owns ChatGPT – OPenAI was valued at up to 29 billion USD and increased nearly 3 times in less than 10 months to 80 billion USD. OpenAI is one of the most valuable technology startups in the world, after ByteDance – owner of TikTok and SpaceX. Meanwhile, xAI, founded by Elon Musk in July 2023, was valued at 24 billion USD after less than 1 year.

AI fever pushes up the value of BigTech

But the real “celebrity” of this AI war belongs to Nvidia, when at the end of May 2023, Nvidia became the first chipmaker in the world to reach a market capitalization of 1,000 billion USD. Despite being the king, Nvidia did not appear in the list of the top 100 famous and iconic global brands in 2023. This makes many people question the sustainability of this most valuable global Brand.

Nvidia becomes the world’s most valuable brand

With the AI fever, the market is witnessing the emergence of a series of brands entering this potential field. Apple and Samsung – two arch-rivals in the smartphone industry – seized the opportunity to apply AI to their products. At the 2024 Worldwide Developers Conference (WWDC), Apple introduced Apple Intelligence – its own personal intelligence system. Accordingly, this technology will be deeply integrated into iOS 18, iPadOS 18 and macOS Sequoia. Meanwhile, Samsung is not far behind, launching the Samsung S24 series with integrated Galaxy AI features.

Apple – Samsung is actively integrating AI into its product lines.

In another development, Canva, the world’s leading graphic design platform, has just announced the acquisition of Leonardo.Ai. Owning Leonardo.Ai helps Canva strengthen its Magic Studio Creative AI toolkit while opening up many new development opportunities. It can be seen that the race to pour money into AI technology is extremely fierce. And many other brands are also applying AI into their businesses and pursuing this new development trend.

Canva and Leonardo.Ai Acquisition

CNN commented that the expectation that AI can revolutionize human life has attracted investors, pouring huge amounts of money into AI companies in many different aspects.

Expectations related to artificial intelligence (AI) have caused US stocks to increase rapidly. Most stocks related to this field have developed rapidly. Many experts are concerned and believe that the “dotcom bubble” may return.

The excitement around AI is being compared to the dotcom bubble of more than two decades ago

Will the dotcom bubble return?

The over-preference for AI is making many people worry about the prospect of a dotcom bubble happening again. The dotcom bubble was a prominent economic and financial event in the 2000s, when the world witnessed the rapid collapse of technology companies. Before that, in 1995, the .com domain name revolution exploded, many organizations and individuals registered to own websites and poured money into a series of potential applications from the World Wide Web – even though they did not bring much actual revenue.

Dotcom bubble – the shocking financial economic event of the 2000s

The dotcom bubble burst in the 2000s, ending a five-year boom for tech companies. That boom seems to be back as the world sees a similar boom in a new wave of startups, this time focused on artificial intelligence.

Will the “dotcom bubble” end with the AI wave?

Actual picture:

Investing billions in AI isn’t paying off for investors. According to the financial report published by Alphabet (Google), since the end of July, the company has started a campaign to convince investors to agree to invest more money in AI. However, the high cost without bringing any practical benefits has made many investors hesitate. In fact, investing billions of dollars in AI cannot bring profits overnight. Even OpenAI itself – the father of Chat GPT with such huge potential – has not made any profit from investing in AI development, not to mention young startups in the same industry.

The future of making money from AI technology is still very unclear. According to Google CEO Sundar Pichai, the technology corporation that is considered to be behind Microsoft in the AI field, has avoided answering questions about the direct benefits of investing in this technology. Meanwhile, Meta’s CFO Susan Li could only reveal that the company will have to spend an additional $ 40 billion between now and 2025 on this AI race. Even Microsoft, the corporation that benefits the most from the success of ChatGPT, only dares to promise that AI will make money after 15 years. Compared to what is spent, AI is bringing a lot of anxiety and disappointment to technology companies around the world.

Stock Market hits new high because of AI: Stock prices are being inflated by optimism about a revolutionary technology. Nvidia – the world’s largest chip company – was dubbed a “money printing machine” when its stock profits increased 8-fold, increasing its capitalization by 2,777 billion USD in just 1 night. In the last 5 years, Nvidia’s stock has increased rapidly, nearly 4,300% – an unbelievable number. This meteoric rise is assessed thanks to the potential of chips for artificial intelligence (AI).

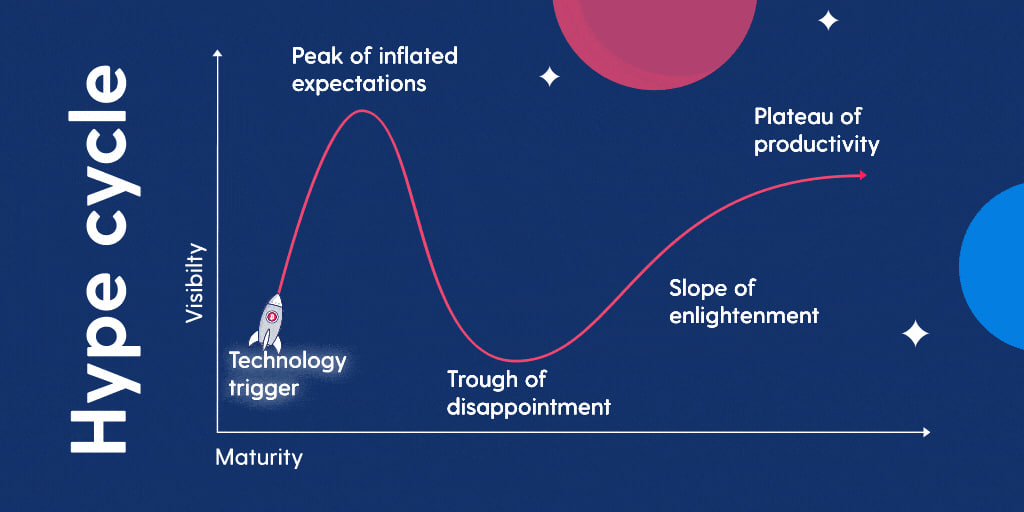

AI predictions from Gartner Cycle, will the future picture “explode”?

Hype Cycle is a concept proposed by the famous American market research firm – Gartner. Hype Cycle provides an overview of the shift of emerging trends related to many fields, from their appearance until these trends/technologies are applied to life.

Gartner Cycle

The cycle consists of five specific stages:

Phase 1 – Technology Emergence: This is the first stage when a new technology emerges and gains widespread public attention. The media will exaggerate the technology’s actual capabilities, causing consumers to have unrealistic expectations for the future that far exceed its initial capabilities.

Stage 2 – Peak of Inflated Expectations: After expectations and user needs have not been fully met, new technology begins to be doubted and criticized. This is the testing stage where the limitations of new technology are “exposed”, causing the community to lose interest and concern.

Stage 3: The Trough of Disillusionment: This is the stage where the true understanding of the technology and its applicability becomes clearer. Companies and investors begin to look for ways to overcome the limitations of the previous two stages, and the technology begins to be applied and accepted.

Stage 4: The Slope of Enlightenment: From the lessons of previous stages, technology at this stage begins to have clear improvements through extensive research and development so that technology can better meet the needs of users.

Stage 5: Plateau of productivity: This is the final stage of the cycle where technology is widely adopted, creating sustainable value for society.

AI is in Phase 2 of the Hype and will “Deflate” in the Future

According to Gartner’s cycle perspective, AI development is exploding in phase 2 and there are many signs of moving to phase 3. Previously, when AI first appeared, it also caused a stir in the technology community with its superior features that were expected to change people’s lives. However, in reality, AI still has many limitations, but the initial hype has covered up these shortcomings of AI, causing users and investors to have expectations that are not commensurate with the actual performance of this type of technology.

In stage 2, “Peak of Hype” – the time when this technology is doubted about its capabilities. Despite huge investment, AI is causing many companies to lose money or not bring in adequate profits. Interest and enthusiasm for AI begins to “deflate” and “burst”. Technology companies need to honestly acknowledge the limitations of AI to have the right strategic moves.

AI needs to be seen in the position it deserves for its real capabilities.

It is time for humans to ground artificial intelligence and give it the status it deserves. No longer hyped or deified, AI will move to the third stage – when the understanding of AI becomes clear and correct. Technology giants will start to find ways to improve the limitations of AI so that this technology gradually becomes more stable, valuable and trustworthy. Only then can AI bring in profits commensurate with what investors spend.

Realizing this, the competition for AI in the market will likely evolve in many other directions, when brands, instead of pouring money into AI, will now be wiser to choose their own moves.

It is still too early to say whether the AI Startup wave will have the same outcome as the dotcom bubble more than two decades ago. Although similar in the way the Internet and AI emerged, were overly interested and “hyped”, the value of technology companies is currently being valued more moderately as the company value has not reached the maximum limit as in the 2000s. The development of AI is still a major concern for many businesses and experts predict in the near future.

Comment Policy: We truly value your comments and appreciate the time you take to share your thoughts and feedback with us.

Note: Comments that are identified as spam or purely promotional will be removed.

To enhance your commenting experience, consider creating a Gravatar account. By adding an avatar and using the same e-mail here, your comments will feature a unique and recognizable avatar, making it easier for other members to identify you.

Please use a valid e-mail address so you can receive notifications when your comments receive replies.