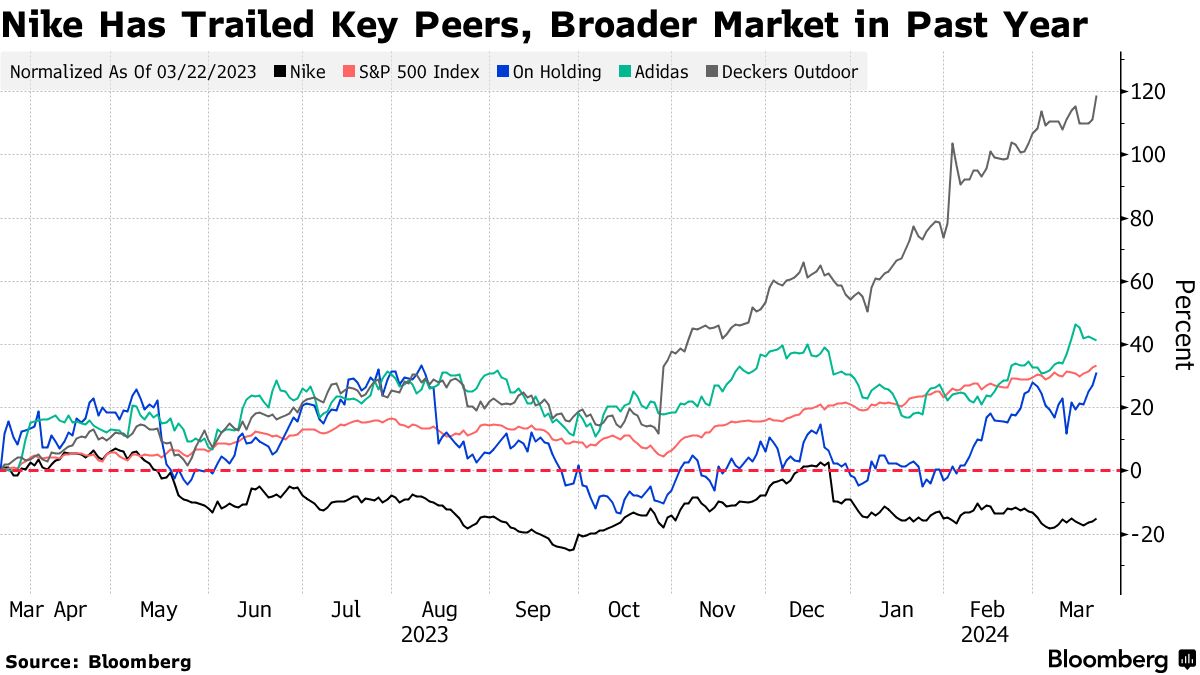

Once an unrivaled giant in the sports accessories market, Nike has been facing an unprecedented revenue crisis and stock price decline over the past 6 months. EURO and the 2024 Olympics seem to be important strategic cards for Nike and CEO John Donahoe turn the tables and look for opportunities to recover.

Nike “evaporates” 28 billion USD in 24 hours – Historic decline and expensive lessons

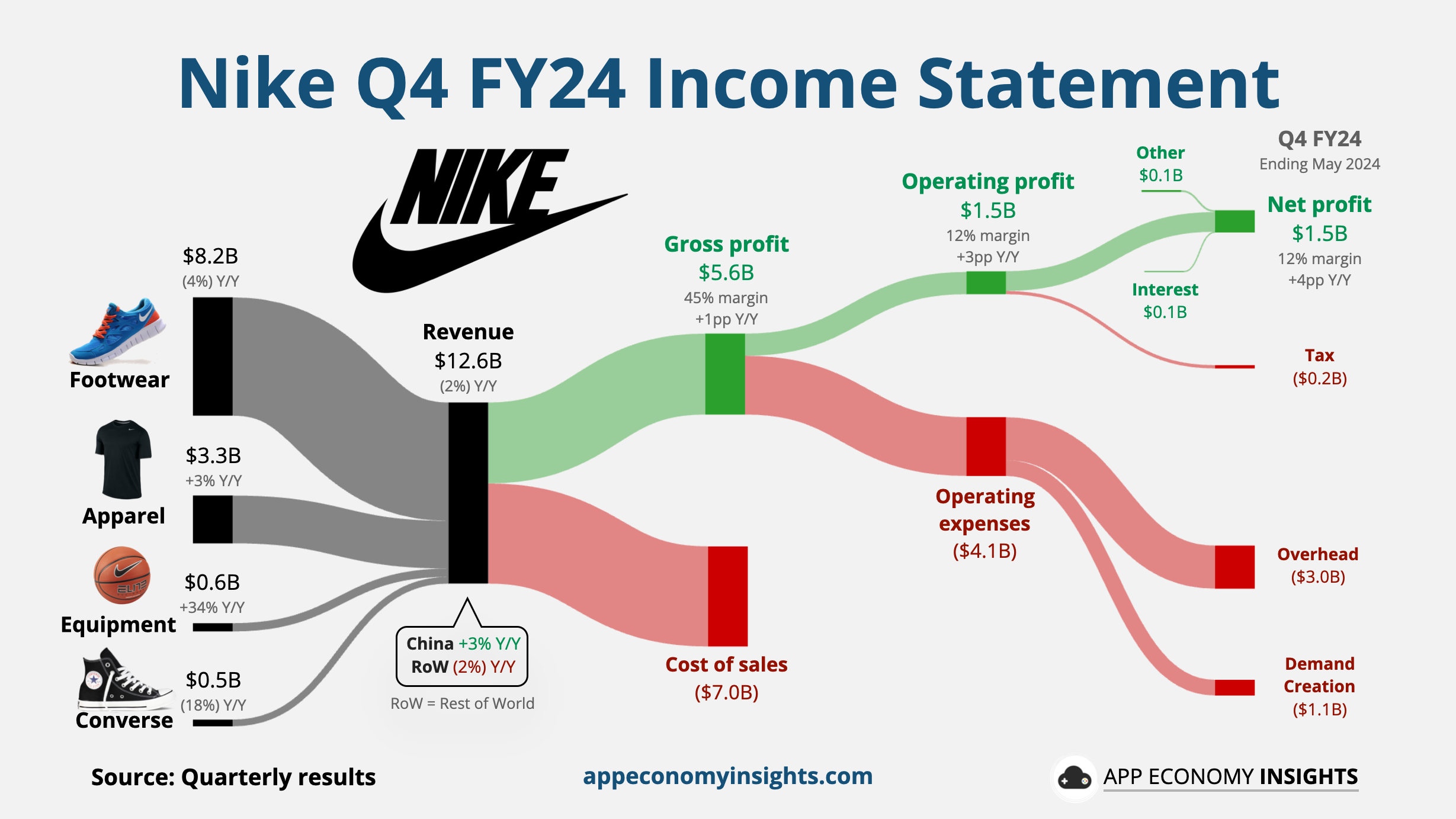

Nike, the sportswear giant that has dominated the industry for two decades, is in crisis with a dismal Q4 2023 to Q1 2024 revenue report. The Brand’s revenue fell 2% to $12.6 billion, far below expectations.

The outlook for the future is also not optimistic. Nike expects second-quarter 2024 revenue to fall by 10%, three times what analysts had predicted, and full-year 2025 growth to decline significantly, reaching a 14-year low.

The revenue slump has shaken investor confidence. Nike’s stock price plummeted 20%, wiping out $28 billion in market capitalization in a single day—the biggest single-day drop in the brand’s history.

The Reason Behind Nike’s Economic Decline

According to Nike, the revenue decline is partly due to the company’s product cycle transition and Sales channel restructuring. However, the recent gloomy business situation shows that the brand is facing many challenges, from business model, product quality to brand reputation.

Nike Loses Market Share After Switching to Direct to Consumers Model

Along with its dismal financial report, Nike is also facing a class action lawsuit alleging that it defrauded investors over its Direct to Consumer (DTC) model, which was supposed to bring Nike closer to customers but instead allowed competitors to dominate the sales channel.

Since 2020, Nike has been cutting back on wholesale and focusing on building a DTC channel in conjunction with its own stores. However, this strategy has caused Nike’s traditional retail partners to “turn their backs.” They have cooperated more closely with other brands, expanding their sales channels and shrinking Nike’s market share.

Nike’s old competitive advantage was no longer strong enough to protect it from market pressures and the rise of new competitors. As a result, Nike was left with a huge $9.7 billion inventory pile – a figure that could have been significantly reduced if it had continued to work with traditional retailers.

Nike is losing ground in its core product market

Once the “king” dominating the sports fashion industry, Nike is now struggling to cope with the difficulties surrounding it. Strategic mistakes combined with the emergence of new competitors have shaken the Nike empire violently. The ambition of “direct sales to consumers” (DTC) has left Nike facing a huge inventory of $9.7 billion. Dumping to clear inventory has seriously affected brand value and put pressure on retailers. At the same time, Nike has focused too much on pushing inventory sales and “begging the past” with legendary shoe models such as Air Force 1 and Air Jordan 1, instead of Investing in innovation and catching up with new trends. As a result, customers have turned away due to lack of innovation, Nike has lost market share to new competitors such as On Running and Hoka. Dumping also negatively affects Nike’s image and brand value.

Can Nike revive its empire or will it continue to sink deeper into crisis? The answer depends on the brand’s ability to adapt and innovate. To regain customer trust, the brand needs to stop dumping to maintain brand value and respect customers, focus on investing in Creative design and keeping up with market trends, as well as listen and understand the needs and desires of customers to bring suitable products.

Nike’s decline in quality on flagship products

Nike, the once-ubiquitous sportswear empire, is facing serious issues with its product quality, especially in the professional sports arena. These scandals not only affect the brand’s reputation but also threaten its leading position in the market.

Recent incidents including Nike’s inconsistent uniforms for players during the Major League Baseball season and the inappropriate design of jumpsuits for the U.S. women’s Olympic track and field team have prompted widespread frustration and criticism from athletes and the public.

The consequences of these scandals are serious: athletes lose confidence in Nike products, the brand image is damaged, and there is a risk of losing market share as customers may switch to other brands.

Professional sports have always been an important testing ground for Nike to prove its product quality and brand reputation. However, with consecutive scandals, the brand is facing a major challenge in restoring customer trust and rebuilding its brand image.

The question is whether Nike can restore customer confidence and emerge from these shocks, or will this be a sign of the weakening of its empire in the sportswear industry.

Nike Focuses All On EURO And 2024 Olympics

2024 promises to be a boom year for Nike with major sporting events such as EURO and the Olympics. This is considered a golden opportunity for the “king” of sports fashion to reaffirm its position, reputation and product quality with global consumers.

CEO John Donahoe expressed strong belief in the potential of these two sports events: “The Paris Games provide us with a pinnacle moment to communicate our vision of sport to the world.” Nike is betting big on a bold marketing strategy, focusing on Olympic products and a brand story centered around sports and athletes. The goal is to have the brand in more than 8,000 stores worldwide.

However, along with opportunities, there are also potential challenges. Nike needs to be careful not to repeat past mistakes such as product quality scandals or ineffective marketing strategies.

Nike has decided to pull out of several major tournaments, including the Premier League and Copa America, possibly to focus its resources on the upcoming Olympics. Ahead of the Paris Olympics, they have introduced two new versions of their Mercurial boots: the Vapor 16 and Superfly 10, as part of a special “Blueprint” collection. This is an opportunity for the brand to showcase a variety of designs for a variety of sports, including a special edition Air Jordan 4 ‘Paris Olympic’.

The brand also hosted an event at the Palais Brongniart in Paris, unveiling the Olympic uniform and 13 AI-created sneakers in collaboration with athletes such as Kylian Mbappe. These activities helped Nike re-establish its connection with consumers and bring evolution to its classic products, while also cementing its position as one of the major brands at this year’s Olympics.

However, the Olympics are just one part of Nike’s strategy. The brand still faces many challenges in terms of distribution and sales channels.

Comment Policy: We truly value your comments and appreciate the time you take to share your thoughts and feedback with us.

Note: Comments that are identified as spam or purely promotional will be removed.

To enhance your commenting experience, consider creating a Gravatar account. By adding an avatar and using the same e-mail here, your comments will feature a unique and recognizable avatar, making it easier for other members to identify you.

Please use a valid e-mail address so you can receive notifications when your comments receive replies.