In the field of strategic management, BCG Matrix (BCG Matrix) has long been an important tool for businesses and managers to shape their product and service development strategies. The Boston Matrix provides a simple and effective approach to classifying and shaping the components of a product portfolio based on growth rate and market share. In this article, let’s join MarkKnow and Learn about the structure, applications and benefits of this Matrix in managing business strategy.

What is BCG Matrix?

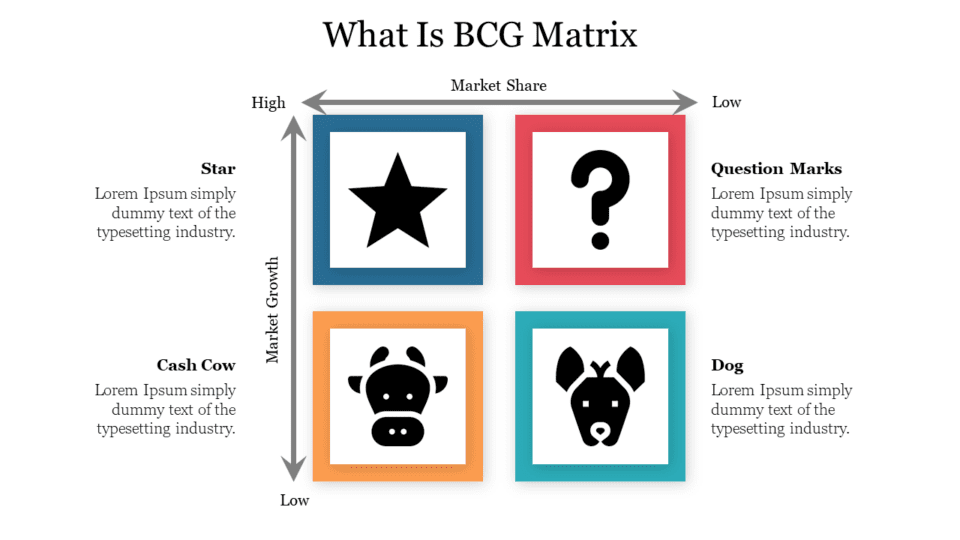

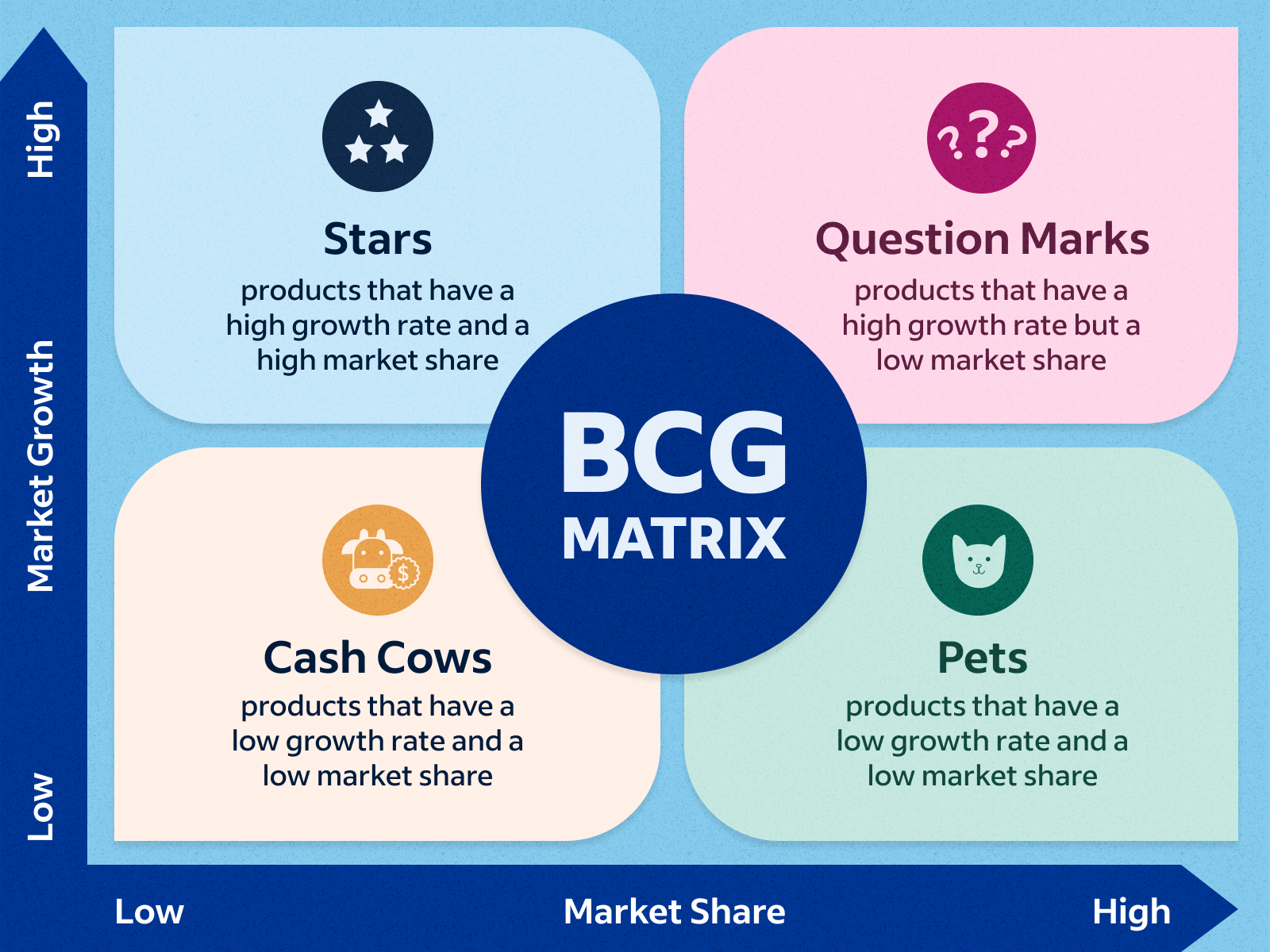

The BCG Matrix, also known as the BCG Matrix, is a tool used to evaluate the strategic position of a product or brand portfolio within a company. Introduced by the Boston Consulting Group in 1970, the matrix is a popular and effective method of portfolio analysis. It organizes a company’s products or services into a 2×2 matrix, with the two axes being low and high performers based on relative market share and market growth rate.

- The horizontal axis of the BCG Matrix shows the market share of the product in a particular market and its strength in the market. Through relative market share, it measures the company’s competitiveness in the market.

- The vertical axis of the BCG Matrix represents the growth rate of the product and its growth opportunities in the specific market.

There are four different quadrants (corresponding to 4 SBUs) in the BCG Matrix:

- “Question Mark” Quadrant: Represents products with high market growth but low market

- “Star” Quadrant: Represents products with high market growth and market share.

- “Dog” Quadrant: Represents products with low market growth and market share.

- “Cash Cow” Quadrant: Represents products with low market growth but high market share.

Elements in the BCG matrix

SBU Dog

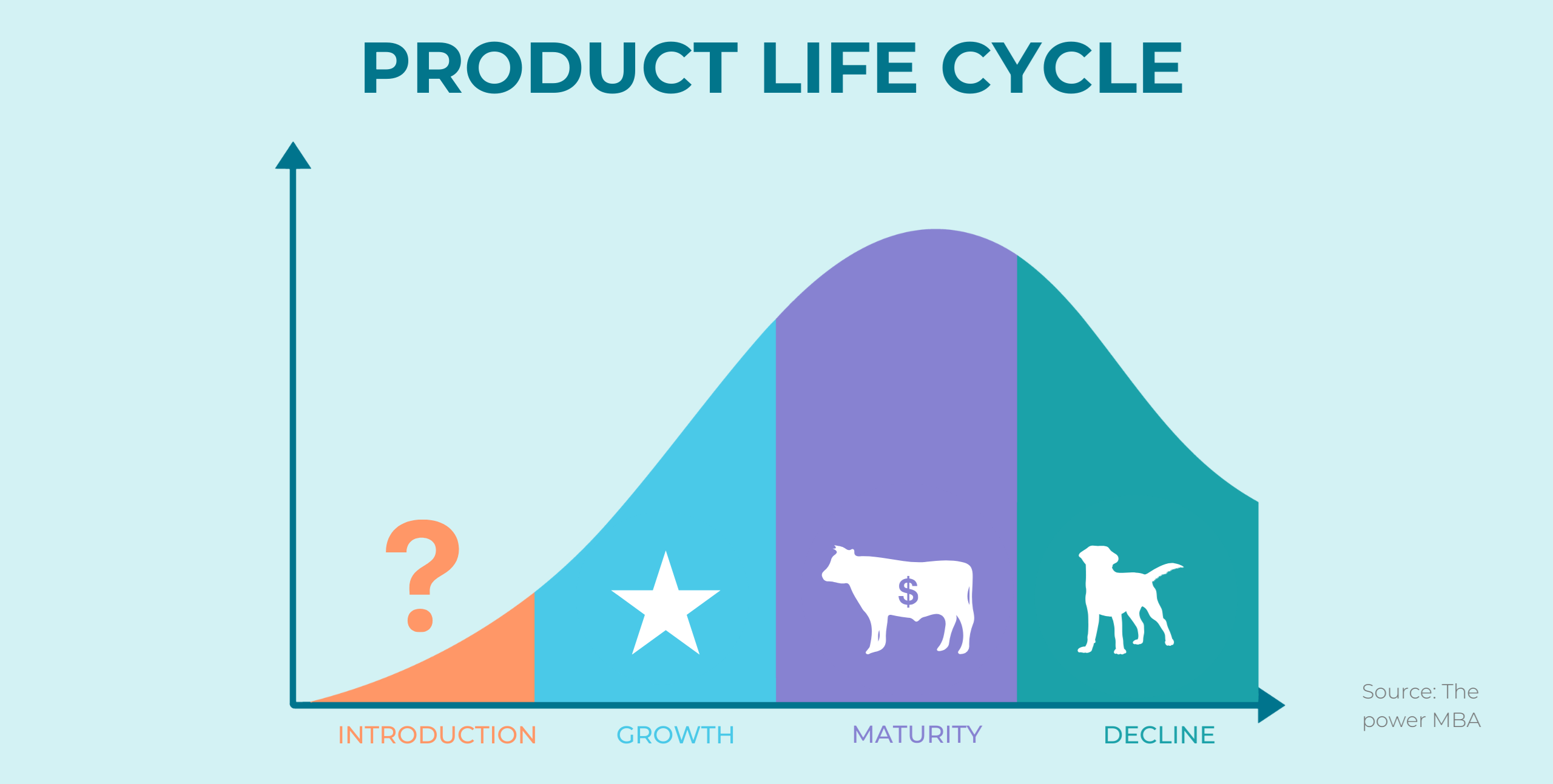

Products in the “Dog” quadrant typically exist in slow-growing markets with low market share. These products are self-sustaining and generate cash flow, but are unlikely to advance to the “Star” quadrant. Companies will typically consider phasing out products in the “Dog” quadrant unless they add value to existing products or play a supporting role in the competition.

SBU Question Mark

Products in the “Question Mark” quadrant typically exist in fast-growing markets, but their market share is low. The “Question Mark” sign represents the most management-intensive products and requires large investments and resources to increase market share. Investments in the “Question Mark” quadrant are often funded from cash flows in the “Cash Cow” quadrant. The optimal goal is to turn “Question Mark” products into “Stars” by increasing market share and achieving product breakthroughs. If unsuccessful, these products can become “Dogs” when market growth slows down.

SBU Star

Products in the “Star” quadrant are typically in high-growth markets with high market share. They are market leaders and are worth Investing in to maintain leadership, drive growth, and maintain a competitive advantage. “Star” products require a lot of capital investment but also generate large cash flows. As the market matures and the product continues to be successful, they can move into the “Cash Cow” quadrant. “Star” products are often highly valued by the company and are a top priority in their product portfolio.

SBU Cash Cow

Products in the “Cash Cow” quadrant typically operate in slow-growing markets and have high market share. They are market leaders and have invested a large amount of resources to build and maintain their position. Cash flows generated by “Cash Cow” products are typically high and are often used to fund “Star” and “Question Mark” products. “Cash Cow” products are considered to be reliable sources of income and the company typically invests less cash in maintaining them while still earning steady profits from them.

Application of BCG Matrix in Strategic Management

BCG Matrix is a powerful strategic management tool, bringing many important benefits to businesses in shaping and managing their product/service portfolio. Applications of this matrix can be listed as:

Shape your Product/Service Portfolio

BCG Matrix helps businesses clearly identify the position of each product or service in a specific market. By classifying products into different quadrants such as “Star,” “Cash Cow,” “Question Mark,” and “Dog,” businesses will have an overview of the contribution and growth potential of each element in the product/service portfolio.

Prioritize Financial and Resource Investments

Depending on where products are positioned in the BCG Matrix, a company can decide where to invest its finances and resources to optimize performance. Products in the “Star” and “Question Mark” quadrants typically require higher investment to gain market share or breakthrough, while “Cash Cow” products can generate cash flow to fund other products.

Product/Service Development Orientation

The BCG matrix helps businesses determine the direction of development for each product or service. “Star” products may require strategies to increase market share, while “Cash Cow” products may focus on maintaining position and optimizing profits.

Optimizing Profits and Balance

By having a reasonable ratio between products in different quadrants, businesses can optimize the profitability of the entire portfolio without being overly dependent on a single product type or market.

Benefits and Limitations of Using the BCG Matrix

Benefits of BCG Matrix

- Support Effective Investment Decisions: By clearly identifying the position of each product in the BCG Matrix, businesses can make decisions to invest finance and resources in products with higher potential. This helps to optimize profits and enhance capital efficiency.

- Oversimplification of Reality: BCG Matrix may oversimplify reality by classifying products into only four quadrants. In reality, the classification may be more complex and other factors need to be considered.

- Limited Predictability in a Changing Environment: Businesses operate in a constantly changing environment and the BCG Matrix may not be able to fully predict future changes. Products may change their position in the BCG Matrix due to many factors.

The BCG matrix offers many benefits for strategic management, however, it should be used in conjunction with other tools and information to gain a more comprehensive and accurate view of the product/service portfolio and market.

How to implement BCG Matrix in practice

To effectively implement the BCG Matrix in practice, you need to follow a series of specific steps:

Step 1. Select the unit of analysis

First, you need to determine the units you want to analyze using the BCG Matrix. This could be individual SBUs (business units), brands, products, or even the entire company. This choice will affect how you conduct the analysis and the final results.

Step 2. Identify a specific market

Identifying your target market is a crucial step. Accurate market analysis is essential to making accurate segmentations, and vice versa. For example, an analysis of Daimler’s Mercedes-Benz brand may yield different results in the passenger car market than in the luxury car market.

Step 3. Calculate Relative Market Share

In this step, you need to calculate the relative market share based on the brand’s revenue or market share in the respective market. This can be done by dividing the brand’s market share by the market share of its largest competitor. This will help you position your brand in the matrix.

Step 4. Determine market growth rate

You need to determine the market growth rate by looking at information from industry reports or calculating based on the average revenue growth of companies in the industry. This will help you determine whether the market is growing fast or slow and create a frame of reference for evaluating the brand’s position in the market.

Step 5. Evaluate and Plot

Based on the calculations you have made in the steps above, you can draw charts on the BCG matrix. Each brand will be represented by a circle with the size corresponding to the percentage of revenue that the brand generates. This helps you visualize the position of each brand in the BCG Matrix.

In the process of business development, BCG Matrix is a useful tool to shape the strategy and manage the product/service portfolio of the enterprise. Applying BCG Matrix helps the company determine the position of each product/service in the market environment and focus on effective investment and development. Please apply the knowledge immediately. MarkKnow just introduced to achieve more success!

Comment Policy: We truly value your comments and appreciate the time you take to share your thoughts and feedback with us.

Note: Comments that are identified as spam or purely promotional will be removed.

To enhance your commenting experience, consider creating a Gravatar account. By adding an avatar and using the same e-mail here, your comments will feature a unique and recognizable avatar, making it easier for other members to identify you.

Please use a valid e-mail address so you can receive notifications when your comments receive replies.