After positive signals about inflation in 2024, consumer spending and shopping trends are expected to have significant changes in the second half of 2024 and 2025. Follow the market report from NielsenIQ to see new consumer insights as well as their consumption trends before the new year.

– 62% are likely to spend more on at-home experiences to save on restaurant and entertainment costs.

Consumer sentiment will become more positive in 2025

The global consumer situation is showing more optimistic signs. They believe in the ability to recover after the economic recession but are also very wary of the risks of continued crises. Therefore, consumers are paying close attention to every aspect of their daily spending.

In particular, inflation is gradually returning to normal levels, monthly global CPG inflation growth has slowed to 1.7% over the same period last year. and some central banks have also begun to lower or lower Interest rates are about to be lowered. These factors are expected to promote more positive consumer sentiment, especially in interest rate-sensitive sectors such as housing and high-value goods.

Consumers are becoming more transparent about their spending, becoming stronger and more optimistic

Consumers are adjusting their spending in the areas that matter most, shifting from cautious consumption to consumption with a more specific and clear purpose. To face the political, economic and environmental changes that are likely to take place in the coming months.

30% of global consumers say their financial situation is better than a year ago, up 2% from January 2024. In contrast, 32% said their financial situation had worsened over the past year – down 2% compared to January 2024. These numbers show that the level of consumer optimism has improved significantly.

Consumers still face inevitable pressures

Although there have been many positive changes, in general consumers still cannot avoid the pressure from increasing living costs. Among the 32% of consumers who shared their financial situation worsening above, up to 76% said the cause was due to increased living costs. In addition to living costs, consumers also say their finances have been adversely affected by the economic downturn (41%) and the unstable job market (31%). These factors will have an impact in the long term, causing spending growth to be constrained in 2025 and the following years.

Concerns weighing on consumers’ minds

Rising food prices, utility costs and the threat of economic recession, etc. continue to be factors that make consumers feel pressured to spend. In addition, in recent times, new concerns have arisen such as: Extreme weather changes in some areas, Personal welfare,… Meanwhile, some issues of the The previous period such as: Housing costs, global conflicts,… no longer had as heavy an impact on consumers as the previous period.

Overall, it is clear that consumers are allocating their spending in a highly purposeful manner and that any surplus is being used carefully and strategically. Although inflation has decelerated, its multi-year compounding effects have had a profound impact on consumers, pushing them to spend less on some categories even as they earn more.

Consumer spending trends and spending cuts in 2025

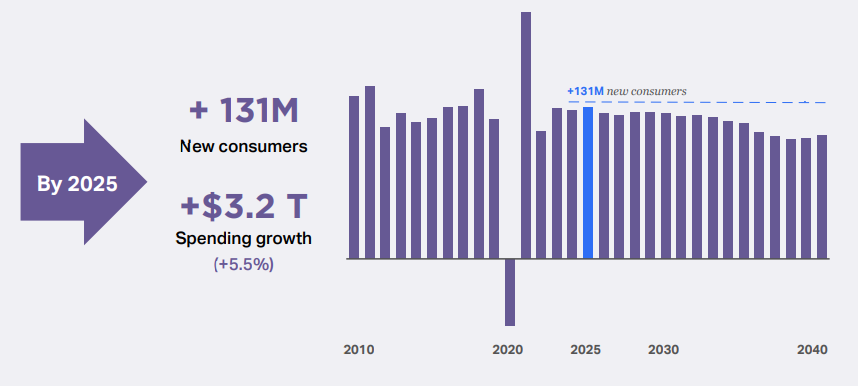

According to WDL, global consumer spending will grow by nearly 6% in 2025. This will equate to about $3.2 trillion in new spending that will arise in 2025. In particular, WDL predicts that Half of new spending in 2025 will come from consumers becoming wealthier, up from 48% in 2024.

Consumer Structure Worldwide

We will have 131 million new consumers joining different consumer classes by 2025. However, it is expected that from now until 2040, the growth rate of new consumer groups will begin to slow down. Therefore, companies will need to make more efforts to attract new consumers while retaining their old consumer groups. Worldwide, there will only be about 17 countries with over 1 million new customers entering the market in 2025. This is a pretty good signal for brands to continue expanding their customer base during this time.

The structure and spending levels of consumer groups have also changed significantly. By 2025, it is expected that the group of low-average consumers spending between 12 and 40 USD/day will account for 35% of the number of consumers, but they will only account for 21% of total global spending. In contrast, upper-class people spending more than $120/day will only account for 3% of global consumers, but account for 33% of total spending by 2025.

Trend of cutting and increasing spending on some services and products: Home services are on the rise

- 54% of Consumers only buy what will be used

- 43% Spend more time at home

- 41% Plan before shopping to manage spending

- 62% are likely to spend more on at-home experiences to save on restaurant and entertainment costs

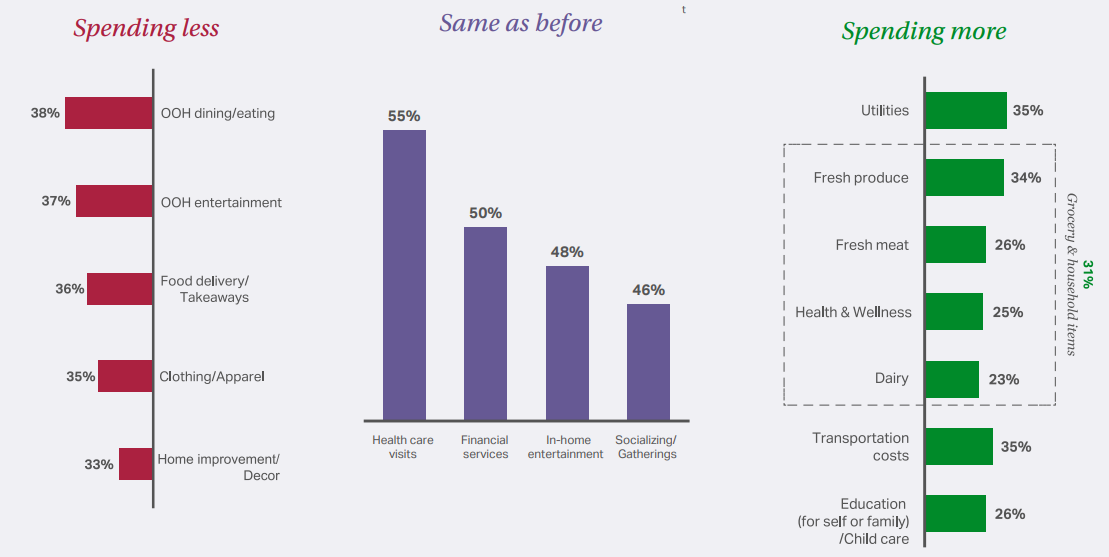

The above numbers show that consumers are increasingly focusing on spending more on essential products and eliminating non-essential products in their spending plans. In particular, they are spending more time at home instead of experiencing outside products and services. Therefore, spending on home entertainment products and services will also increase in the near future.

Specifically, the items with the most spending cuts today include: Outdoor meals & entertainment, Food delivery services, Clothing and Home Decoration,… are all product groups. Services related to entertainment and entertainment needs and not really essential in consumers’ lives.

Meanwhile, consumers are expected to spend more on educational products for themselves and their families in the near future. This shows that consumers are ready to invest in development for themselves and their families that brings more long-term prosperity than short-term entertainment.

Planned spending in the next 12 months

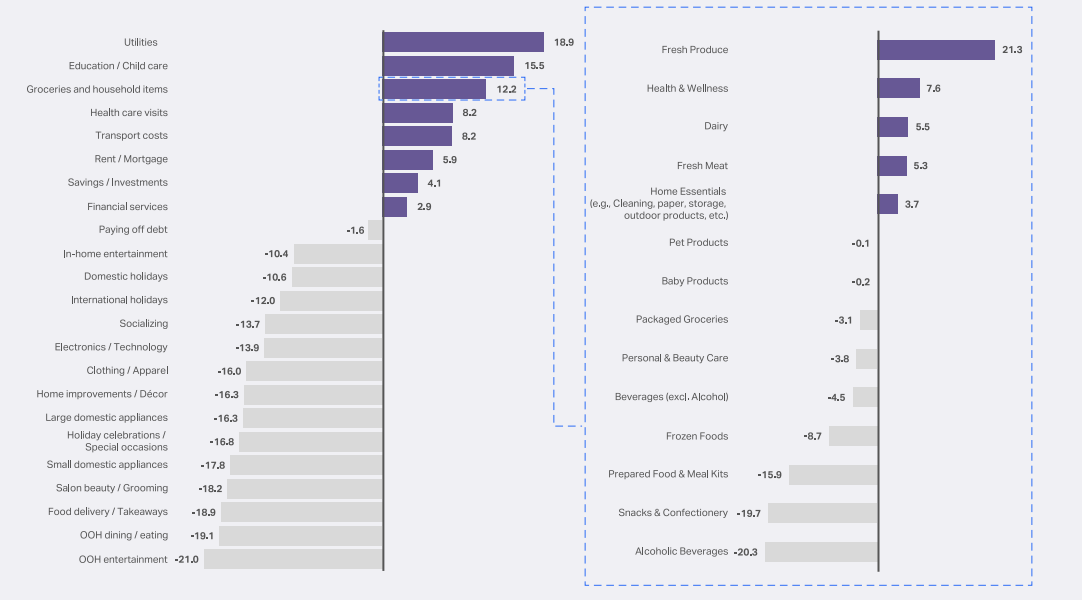

Over the next 12 months, items likely to see higher spending include:

- Utilities

- Education/Child Care grew strongly

- Groceries and household essentials — especially fresh, health-care produce — are a top priority.

- Physical examination

- Travel expenses

- Rent/Mortgage Costs

- Savings/Investment

- Financial services

Among the above items, there are many “fixed” expenses such as electricity, rent, health examination costs, etc. – most of which are “non-negotiable” essential expenses. That’s why despite feeling more financially stable, consumers still face unavoidable expenses in life, affecting their ability to spend on other non-essential product categories. .

Consumer Characteristics in 2025

Consumers redefine “discounts,” seeking ways to reduce costs

For consumers, affordability and price are always the basic factors that form their decisions. However, as inflation has stabilized and in recent months, consumers have had a slight change in their perception of “discounts.” Nowadays, they not only look for products with reasonable prices but also expect shopping methods that help optimize costs.

- 67% are likely to change or try a new Brand because of the lower price.

- 70% will buy a product that is energy efficient or low cost to run

- 45% would use natural ingredients or alternative food products in their beauty care (e.g. beetroot for skin pigmentation/blush, rosemary hair oil, etc).

- 67% are willing to buy a product that has been improved to be as affordable as possible. For example, when a new improved product appears, consumers are most likely to change their choice if the price of that product is equivalent or “still affordable” compared to the old product they are using.

In general, today’s user spending decisions are quite complicated. They expect the effectiveness and quality of the product but also make great efforts to find other options with lower prices across many Sales channels and many different brands. This requires brands to make continuous efforts in developing new products that optimize old products and have measures to prove the product’s effectiveness on consumer problems.

Discount spending methods that consumers are favoring:

When you understand the following “formulas” for saving consumers’ spending, you will have the opportunity to conquer them more easily in the future:

- Buy any brand on sale for 36% off

- Switch to 36% lower price option

- Shop more often at 32% lower discount/value/price stores

- Track costs for entire shopping cart 32%

- Stop buying certain products to focus on essentials 32%

- Stock up or buy in bulk when everything is on sale for 28% off

- Shop online for better deals or save 27%

- Collect/Use Loyalty Points to Manage Spending 26%

- Use digital technology to find 24% better deals

- Replace/Change to an alternative product that costs 23% less

Thus, it can be seen that promotional programs still have great weight for consumers today. In addition, they are also trying to find options with lower prices or look for sales channels with more incentives.

How do costs affect consumers?

We can clearly see two directions for cutting consumer shopping costs today: Reducing product usage costs and Reducing product purchase costs.

- Reduce usage costs: 65% of consumers share that they are switching to buying more products packaged in large sizes or buying in larger quantities.

- Reduce purchasing costs: Meanwhile, 52% choose to buy more products in smaller packages.

This depends on the budget level as well as the needs of each user.

Consumers are willing to “spend money” on premium services and products to satisfy themselves

- 56% of consumers share they could spend a little more to make a moment or day of the week more special or enjoyable.

- 55% spend more for convenience.

These numbers show that consumers are willing to spend more to achieve comfort and convenience while using products and services. Especially the younger generation like millennials and genz are the ones willing to spend the most money on comfort. Therefore, this group of consumers is a golden opportunity for retailers to develop upgraded product services, creating convenience and new experiences during use.

Link Download Consumer Trends Report 2025

Google Drive Download Consumer Trends Report 2025

Direct Download Consumer Trends Report 2025

Summarize:

Overall, through NielsenIQ’s report, we can see a number of outstanding points such as: the growth of home entertainment services, consumers’ discount purchasing strategies, and especially the types of products that will prioritize or cut spending in 2025. Download the detailed report here now, to more specifically grasp indispensable data about consumers in the coming year!

Source: NielsenIQ

Comment Policy: We truly value your comments and appreciate the time you take to share your thoughts and feedback with us.

Note: Comments that are identified as spam or purely promotional will be removed.

To enhance your commenting experience, consider creating a Gravatar account. By adding an avatar and using the same e-mail here, your comments will feature a unique and recognizable avatar, making it easier for other members to identify you.

Please use a valid e-mail address so you can receive notifications when your comments receive replies.